Create a Fund

HJCF’s long-term approach to giving facilitates your charitable intentions during and beyond your lifetime. We offer a variety of options to help you meet your philanthropic goals, including Donor Advised Funds, Legacy Funds, Designated Funds and Agency Funds. Based on our experience, knowledge, and understanding of your specific philanthropic vision, we help you select the option best suited to your needs.

Donor Advised Fund

A Donor Advised Fund is a special account in your name that allows you to invest in the causes you care about. It offers several benefits to direct giving. You can:

Support all your favorite charitable organizations with a single donation

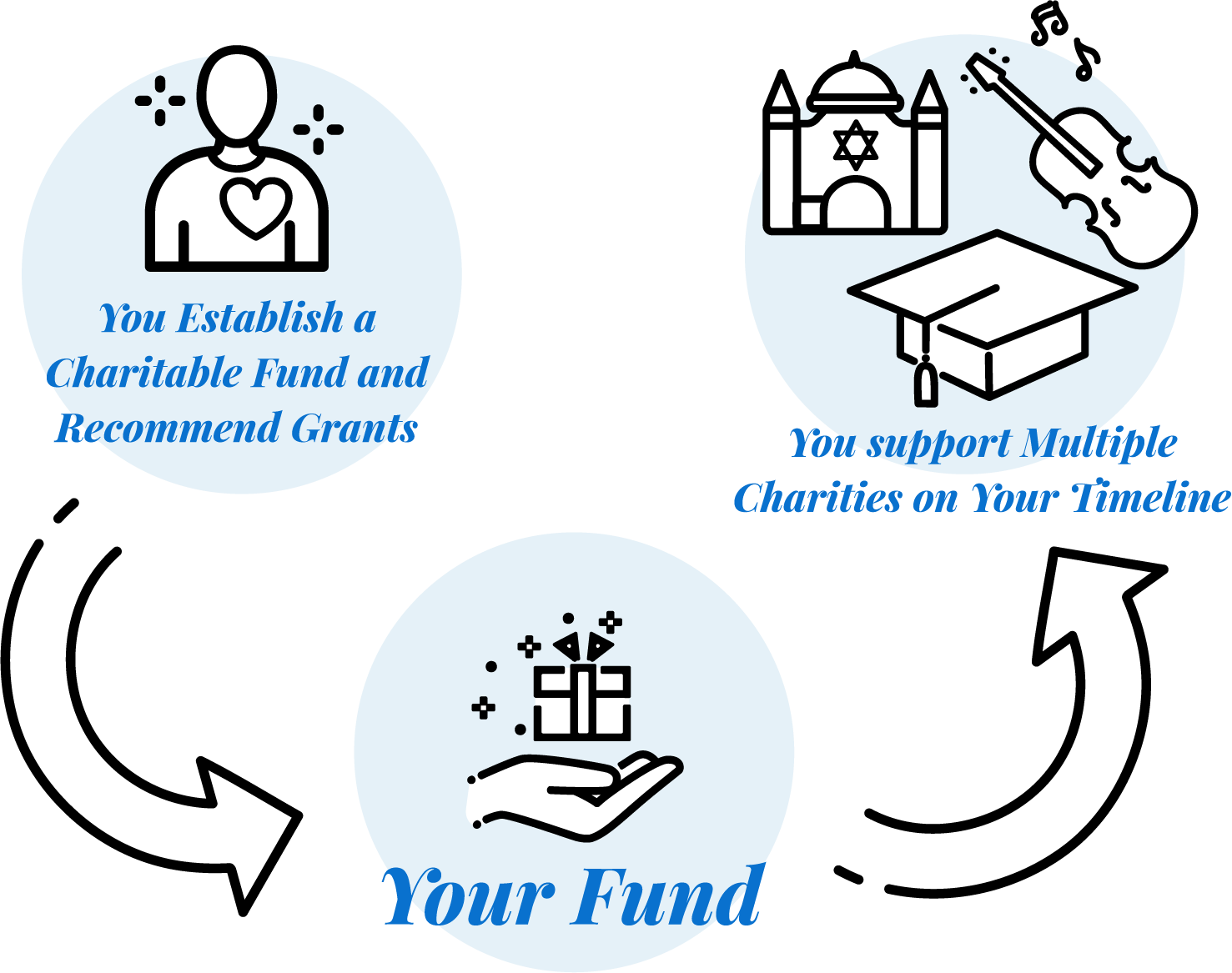

How a Donor Advised Fund works

You can start your fund with a tax-deductible contribution of $2,500 or more in cash, appreciated stock or other non-cash assets. We can help you quickly and easily donate complex assets including charitable gifts of real estate, privately held business interests and other alternative asset gifts. Any time you like, you can recommend that grants be made from the fund to the specific charities you wish to support. This eliminates the pressure to make these decisions at the end of each year. Once HJCF has reviewed and approved the grant, a check with a customized cover letter will be sent to the charity, referencing your fund name. The charities selected must be 501(c)(3) organizations.

The assets in the HJCF’s Donor Advised Funds are invested and grow tax-free in five diversified portfolios, managed by our external investment manager, Fiducient Advisors. Our Investment Committee, comprised of experienced experts from the community, provides oversight.

5 Reasons to Have Your Designated/Field of Interest Fund with HJCF

5 Reasons to Have Your

Donor Advised Fund with HJCF

1.

We treat you like family.

2.

Working with us is easy

3.

It doesn’t take a large gift to get started.

You can start your Designated/Field of Interest Fund with a gift of $2,500, and it can encompass more than just cash and stock donations. You may be able to attain a new level of giving through assets you already own.

4.

We are well-connected but independent

5.

We are a not-for-profit organization.

See why an HJCF Donor Advised Fund is a smart way to give.

Ways to Start Your Fund

Appreciated Stock

Cash

Real Estate

Financial Interest in

LLC or Partnership

Contact us to start your fund.

Legacy Funds

Making a bequest to HJCF provides an easy way to ensure your charitable giving goals are fulfilled after your death.

You have several options for funding the bequest you make to HJCF in your will. These include:

A specific dollar amount or

percentage of your estate

How to Establish a Legacy Fund at HJCF

We work with you to create a document describing in detail how you would like your after-lifetime gift to HJCF in your estate plan to be distributed. You can make changes to this distribution plan document at any time during your lifetime, at no cost. We are happy to work with your progressional advisors such as attorneys and accountants.

Think of this as a placeholder fund for your future legacy gift. Simply add the fund name and HJCF tax id to your will.

How the Legacy Fund is Distributed

Once HJCF receives the money or assets, we distribute it according to the instructions in your plan. The funds can be distributed immediately or over a number of years. They can be added to an existing Donor Advised Fund or used to create new ones in the name of children or grandchildren. Another option is to establish a community fund in the donor’s name or add the funds to our general community endowment fund. In either case, the earnings will be distributed annually through our grants process.

About Endowment

Sample Legacy Fund Ideas

- Create a source of support for one or more charitable organizations.

- Address future needs by creating a competitive grant cycle for a specific area of need.

- Encourage education by creating a college scholarship.

Designated/Field of Interest Funds

How a Designated Fund Works

Designated IRA Charitable Rollover Fund

We can help you turn your IRAs into gifts to your favorite charities by creating a designated IRA Charitable Rollover fund. Donors over age 70 ½ can make a gift of up to $100,000 annually from your IRA. Before you make your gift, we work with you to create a plan to distribute the money to designated organizations for a designated number of years. Once the plan is made, the organizations and amounts cannot be changed.

When you transfer this money as a gift to HJCF, you satisfy your required minimum distribution (RMD) each year, so you do not need to pay taxes on the money as you would if you were to take a RMD.

Agency Funds

We manage endowments for numerous Jewish organizations in the Texas community, working closely with the agency boards and investment committees to ensure their assets meet their growth and risk goals.

Contact us to learn more about how we can help your organization.